What is it

Ardent Health (ARDT) operates healthcare facilities, specifically hospitals. They are headquartered out of Nashville, Tennessee. They currently operate 30 acute care hospitals in Idaho, New Jersey, Kansas, New Mexico, Oklahoma, and Texas. These thirty hospitals are comprised of 280 “sites of care” and they employ nearly 2,000 people. Ardent Health operates their hospitals on both an independent and joint venture basis. Ardent’s JV model is structured so that when a JV is formed, they retain the majority stake and their partner retains the minority stake. Some of these JVs do qualify as VIEs. Many of these JVs are partnerships with academic institutions, community hospitals, large not-for-profits, etc.

Ardent receives reimbursement from the traditional payor channels: Medicare, Medicaid, Group Medical Insurers, HMOs, PPOs, etc. Each of the hospitals operated by Ardent are eligible to participate in both Medicare and Medicaid.

Unlike many of its counterparts that operate hospitals, Ardent does not own the real estate, they instead lease their facilities.

History

Ardent Health has existed in some form since the 90s. Originally a behavioral health focused company, the firm was named “Behavioral Health Corporation.” As the company evolved, they divested their behavioral health operations in 2005. The focus of the company following the divestment was on acute care hospitals.

In 2015, Ardent structured a deal with Ventas (VTR) and Equity Group Investments (EGI), a firm founded by Sam Zell. The deal was structured in such a way that EGI would be the majority owner of Ardent’s operating hospital company and Ventas would retain Ardent’s real estate as well as a 9.9% interest in the hospital operating company. The transaction valued Ardent at $475 million. Following the transaction, Ardent’s real estate was leased to them by Ventas on a long term (20 year) triple-net lease, expiring in 2035. The deal was a success for EGI as prior to their investment, Ardent operated 14 hospitals in three states with $2 billion of revenues. By YE 2020 Ardent operated 30 hospitals in six states with $4.3 billion in annual revenues.

In 2022, Ardent received a $500 million equity investment from a UAE based firm, Pure Health.

The company went public on July 19, 2024 offering 12,000,000 shares at $16.00/sh for gross proceeds of $192 million (net $181.4 million). Since the IPO shares are down ~50% to approx. $9.00/sh today.

Facilities & Operating Model

Ardent Health facilities are located in Idaho, New Jersey, Kansas, New Mexico, Oklahoma, and Texas. This includes their 30 acute care hospitals and the 280 sites of care that are contained within those hospitals. For the uninitiated, Pontneuf Medical Center is an acute care hospital, but there is a Pontneuf Surgical Specialist site of care within the hospital system.

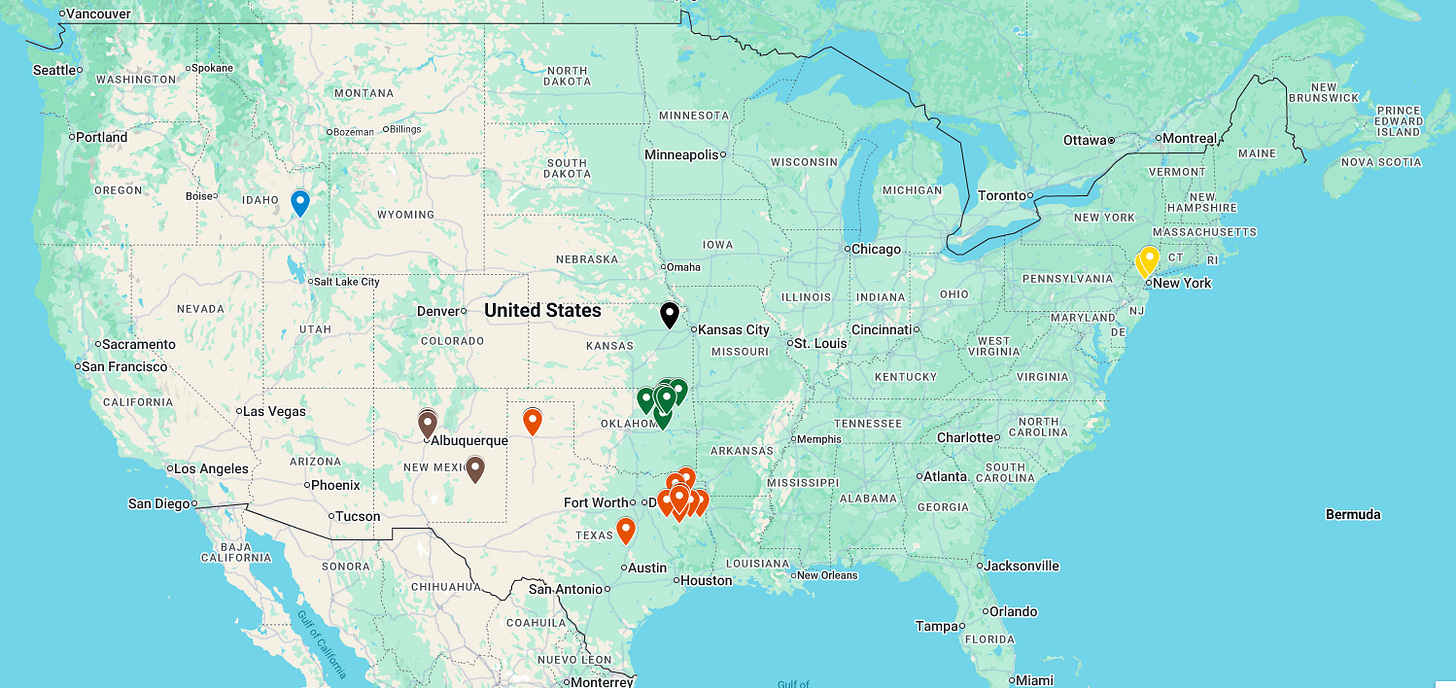

Below is a map I color coded mapping their acute care hospitals. Orange is Texas, green is Oklahoma, brown is New Mexico, black is Kansas, yellow is New Jersey, and blue is Idaho. These are the systems that house the centers of care.

Of the 30 hospitals that Ardent operates, 18 of those are joint ventures. Majority of these joint ventures are with UT Health East Texas with all of the facilities Ardent operates subject to their joint venture agreement. Idaho, Kansas, and New Jersey, are states where Ardent’s presence is entirely via joint ventures.

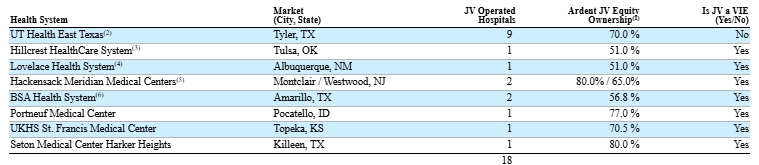

Below is the JV’s, as of the 2024 10-K.

The Ardent JV model retains majority control and equity ownership. Each of these joint ventures are governed by a Board of Directors. There are two classes of directors, one class appointed by Ardent and one class appointed by the JV partner. The JV board is responsible for capital and operating budgets, continuance of the JV, issuance of membership units to prospective members of the JV, merger and acquisition activity of JV assets, indebtedness, etc. Voting procedure is done by block voting, any action that requires approval requires a majority of both classes of directors to approve. I would implore all readers to read page 4 and 5 of the 2024 10-K, which highlights the governance nuances of this joint venture model.

JV Impact on Financial Reporting

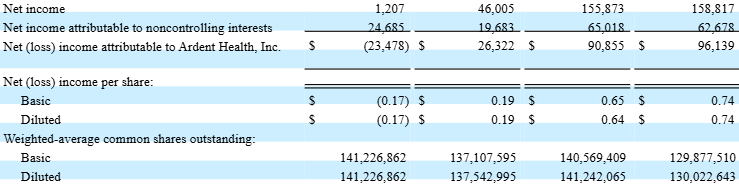

The JV’s do impact financial reporting. There are certain line items that are consolidated with the JVs. In Q3 of 2025, Ardent booked $1.576 billion in revenues. This figure includes JV partner interest. As a quick example of this, if you look at the income statement, everything above the line item “Net income attributable to noncontrolling interests” is consolidated with their JV partner’s proportionate share.

Example from the Q3 10Q:

The third column is the nine months ended September 30, 2025. The EPS figure of $0.65/sh is calculated using the income attributable to Ardent Health, Inc. of $90.8 million and the basic share count of 140,569,409 shares.

However, when you go to the statement of cash flows the net income figure that is used for net income is $155.8 million, which includes noncontrolling interest earnings:

Forgive the poor formatting of the 10-Q.

If you are trying to calculate FCF from the cash flow statement it’s important to understand that the figure you’re using will include the NCI earnings and you must account for this. The adj. EBITDA figure that Ardent reports quarterly is net of noncontrolling earnings share

Ventas Master Lease

The Ventas Master Lease came about in 2015 alongside the Equity Group Investments deal. Ventas purchased ten of Ardent’s hospitals from them and Ardent leased back the facilities under a 20-year master lease expiring in 2035 (known as the Ventas Master Lease). As part of the IPO, Ventas exercised their options and beneficially owns 6.5% of Ardent Health.

The Ventas Master Lease has some covenants that Ardent must remain in compliance with. Notably:

Minimum portfolio coverage ratio of 2.2x

Guarantor fixed charge coverage ratio of 1.2x

Maximum guarantor net leverage ratio of 6.75x

Ardent has spent $114 million in rent expense to the Ventas Master lease for the nine months ending 2025. Additional rent and lease expense for the same period is $81.9 million for a total of $195.9 million. This figure includes consolidated rent and lease expenses with the JV partners.

Payor & Geographic Mix

Briefly, because I have seen someone misunderstand what a payor is:

Payors are the actors that pay claims on behalf of an insured. In the case where an individual forgoes insurance or pays claims independently, they are classified as “self-pay.” It is extremely important to understand this distinction, I saw someone one time write “70 million payors” when discussing a certain health insurance company. This is incorrect. Payors are not the insureds or members of a health plan; they are the institutions that are responsible for paying claims.

Understanding payor mix is crucial as healthcare insurance in the US is heavily regulated. Reimbursement rates for government programs are set by CMS or state regulators depending on the program and legislation can drastically impact the economics of the program. As an example, Medicaid programs often involve CMS, the respective state’s Department of Health and Human Services (or the like), and a managed Medicaid company (payors such as Molina, Centene, United, etc.). The state will take federal dollars allocated to the state’s Medicaid program alongside their own general funds and cover Medicaid eligible individuals.

Below is the payor mix for Ardent Health:

Medicare and private payors (the BUCAs) make up the brunt of Ardent’s revenue. Medicaid is approximately 10% of the revenue.

The geographic make up for Ardent’s revenue below:

Financials & Results

Starting with the balance sheet, Ardent is well capitalized and the balance sheet is is not concerning. As mentioned previously, given the nature of their JV model, a portion of the assets and liabilities will include the proportionate share of their JV partners. This is fine as these funds are commingled for operational purposes.

Ardent currently has a market capitalization of $1.26 billion. Currently, Ardent has $609.4 million in cash and cash equivalents on its balance sheet and carries total long term debt of $1.1 billion along with $1.17 billion of operating lease liabilities ($908 million of which are related party – Ventas Master Lease). Ardent’s enterprise value is $2.9 billion.

The long-term debt is made up predominantly of Senior Secured Credit Facilities and the 5.75% senior notes.

The senior secured facility is made up of the Term Loan B Facility and ABL facility, collectively referred to as Senior Secured Credit Facilities in the filed reports. In September 2025, Ardent refinanced their Term Loan B facility which reduced the interest 50bps to Term SOFR plus 2.25% and the base rate to 1.25%. The refinance extended the maturity to September 18, 2032. The total principal refinanced was $777.5 million.

The ABL Credit Agreement is $325 million maturing June 26, 2029. There are two tranches to this ABL, one tranche is $275 million non-UT Health East Texas borrowers’ tranche and the remaining $50 million UT Health East Texas borrowers’ tranche specifically available to the East Texas Health System, LLC subsidiary. This is a revolving credit facility available to

The 5.75% senior notes were issued in July of 2021 and mature July 15, 2029 with a principal amount of $300 million payable semi-annually.

The maturity profile of Ardent’s debt is favorable even when you consider the Ventas Master Lease operating lease liabilities, which doesn’t mature until 2030. The bulk of the debt matures after 2029 with favorable interest rates following the 5.75% Senior Note issuance in 2021 and the refi of the Term Loan B facility in September of 2025.

In the nine months ended September 30, 2025, Ardent and its JV partners earned $155.8 million in net income. $90.8 million of which is attributable to Ardent. The stock currently trades at about 6-7x LTM P/E multiple. Ardent reports an adjusted EBITDA figure, but I am not a fan of it as it stripped out certain key figures such as their New Mexico Professional Liability Accrual, change in accounting estimate, and expenses related to Epic. I went through their adj. EBITDA addback and calculated EBITDA on a standalone basis. Below is Ardent’s LTM EBITDA:

Ardent’s LTM EBITDA was $478 million. With an enterprise value of $2.9 billion Ardent trades at a 6x LTM EV/EBITDA. This includes worse than expected third quarter 2025 results. Regarding what I expect from the firm over the next twelve months, I believe there are a few promising trends. Admissions have steadily grown 5.8% YoY, keeping in line with their historical result of mid-single digit admissions growth and surgery growth turned positive in the third quarter. Revenues continue growing at a high single digit rate. If I look out over the next twelve months I believe EBITDA, including headwinds from certain regulatory actions, namely DSH payment reductions, could grow low double digits. I am typically cautious with projections and couple that with DSH payment headwinds I want to underestimate. I believe 10% EBITDA growth is possible, despite their adj. EBITDA growth being consistently 25%-40%, I prefer to be prudent and pare down my expectations. If Ardent is able to grow EBITDA 10% they will be trading at 5x EV/EBITDA, this figure even includes the one time charges to self insurance and revenue cycle adjustments, which won’t persist in the following quarters.

Headwind

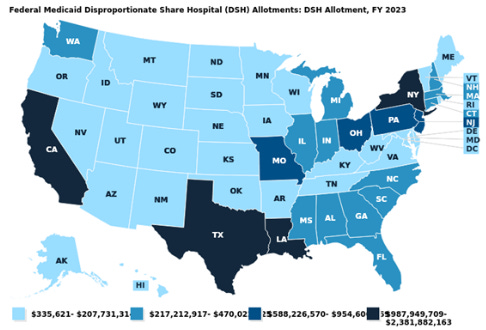

The One Big Beautiful Bill Act (OBBA) includes language regarding a government program called Disproportionate Share Hospital (DSH) payments. These payments began in the 1980s to support hospitals that provide care to uninsured/low-income patients. DSH payments are being reduced by $24 billion over the next three years in equal increments. $8 billion each year until 2028, at which point DSH payments will be around $16 billion annually.

The states most impacted by DSH payment reductions are New York, Texas, Louisiana, and California. New Jersey is also impacted by these reductions, but less so than the aforementioned states. The geographic impact of these payment reductions matters quite a bit, it’s $24 billion over the next 3 years being removed as a potential source of revenue from Medicaid providers. Note the map below from KFF:

The silver lining for Ardent with DSH payment reductions is that even though they occupy a few states that will be impacted, only 10% of their payor mix is Medicaid with half of their revenue being sourced from states other than Texas and New Jersey. There have also been Directed Payment Programs stood up by states such as New Mexico to buffer federal cuts to Medicaid providers.

The more persistent headwind that I am focusing on is elevated payor denials. Management at Ardent called out on the call that payor denials are becoming more pronounced. There’s a bit of a game being played with coding and billing between the payors and providers currently, with new technologies assisting providers chart, code, manage/identify HCCs (Hierarchical Condition Categories), etc. Denial rates have seen an uptick across the industry.

Third Quarter Stock Decline

In the third quarter, Ardent’s shares fell 40%. This was due to a few things. Ardent adjusted their revenue cycle accounting after implementing their new revenue cycle platform, Kodiak RCA. This caused a $43 million change in accounting estimates. Professional fee growth had been expected to moderate, but accelerated to 11% in the third quarter. Payor denials were more pronounced across the industry.

In New Mexico, Ardent booked an increase to their professional liability reserves due to adverse period development of $54 million, due to a single provider from 2019-2022, this provider is no longer employed at Ardent. This item is non-recurring and in their adj. EBITDA figure, Ardent removes this impact. In my valuation assessment, I used EBITDA, not the reported adj. EBITDA so my valuation includes this for LTM EBITDA. Ardent self insures their professional liability.

Conclusion

In my view, Ardent is undervalued. Prior one-time charges such as the New Mexico professional liability accrual and change in accounting estimate should not weigh on current valuation. If you remove these true one-time charges Ardent is trading at 5x LTM EV/EBITDA, if you include these one-time charges it’s trading at 6x LTM EV/EBITDA, which I also find attractive. Exposure to Medicaid DSH cuts are real, but not cause for concern in my view. Ardent recently authorized a $50 million share repurchase, however, “authorized” means nothing to me, it’s nice to know there is that option however. I think Ardent is attractive at this price.

See disclaimer. I own shares of Ardent Health, ARDT.