Improper Enrollments & Subsidized Healthcare

Improper enrollments: multi-state Medicaid and ACA membership.

On July 17, CMS put out an unprecedented press release (at least unprecedented in the age of the ACA). That upwards of 2.8 million Americans are enrolled in both Medicaid/CHIP in multiple states or enrolled in Medicaid/CHIP and a subsidized ACA plan.

I think the findings here are profound and also an indictment on both the Medicaid/HIX carriers as well as the individual health insurance brokers/agents.

Over the past several months, software engineers collaborated with CMS to examine historical program enrollment data and found that in 2024 an average of 1.2 million Americans each month were enrolled in Medicaid/CHIP in two or more states and an average of 1.6 million Americans each month were enrolled in both Medicaid/CHIP and a subsidized Exchange plan.

As an aside, Oscar Health was at one time a large position for me. I bought it <$3.00/sh and averaged up along the way. My average basis was under $10/sh. That no longer remains true, in fact, I am now short Oscar Health. Not in any serious % of my portfolio, but merely as a way to have exposure to what I foresee as the beginning of a serious period of enrollment audits and further ACA headwinds as the eAPTC sunsets, FTR process changes, and the 150FPL Special Enrollment Period ends. This also comes on the heels of Centene pulling their 2025 guidance and repricing their 2026 rates. Some of the structural ACA headwinds I discussed here:

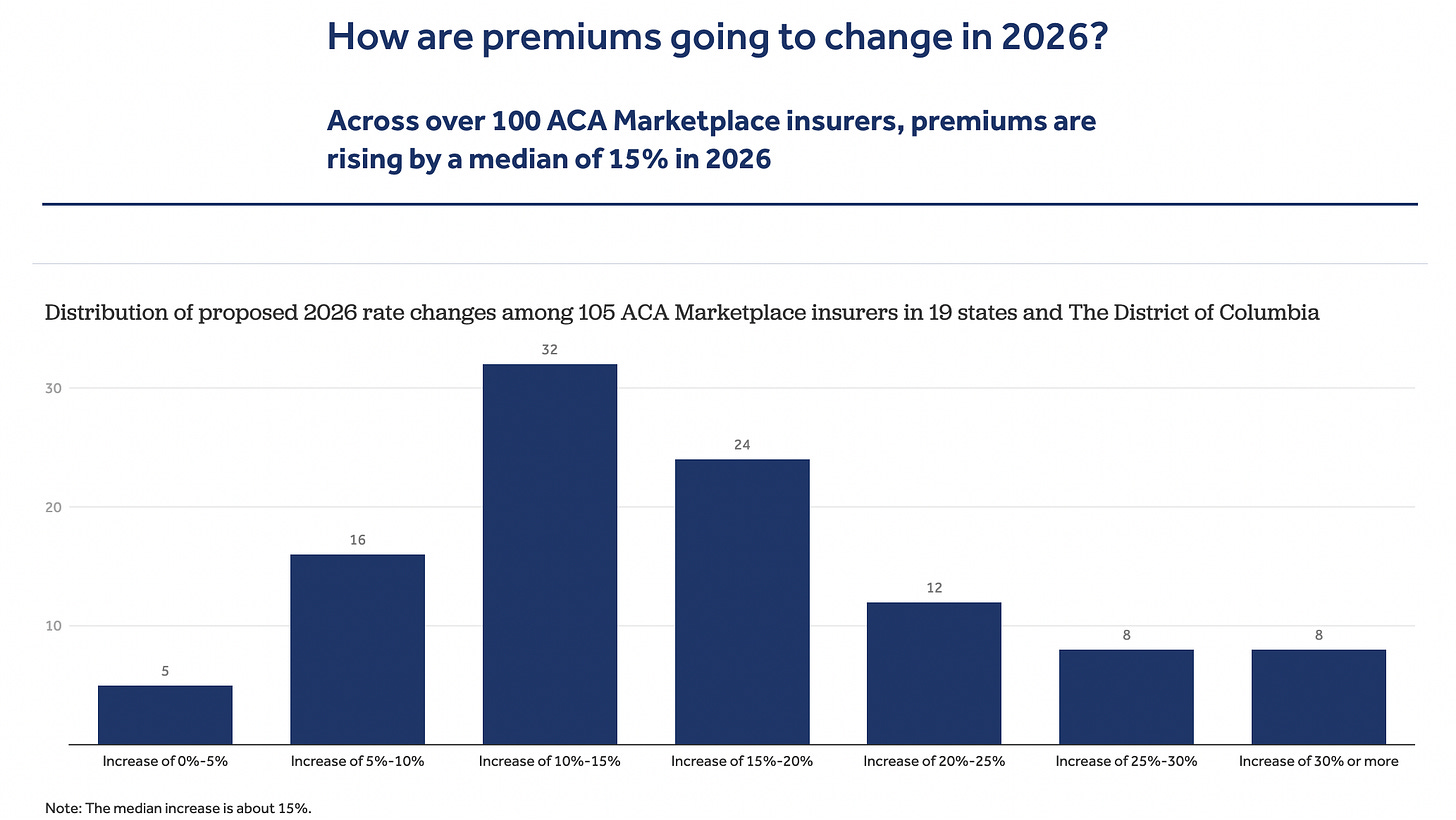

The path forward, no matter how you look at it, is a massive headwind. There will, barring any unforeseeable intervention, a marked reduction in the number of people enrolled on an ACA marketplace plan. This will impact everything from where carriers choose to do business to risk adjuster payments. It creates a lot more opacity regarding the earnings that the ACA will provide these payors. Some people have mentioned the short-tail nature of health insurance and how quickly repricing can occur. This is true, undeniably so, but if the denominator (membership) shrinks materially and certain cost pressures remain (Elevance HIX members utilize ER at 2x the rate of commercial members), there is no rate increase that a regulator will approve that can save you on its own. It will need to be coupled with other actions, whether at the carrier level or by a regulator. In fact, many of the individual exchange insurers are already doing exactly that, filing for significant rate increases1.

The individuals relevant to the CMS press release are dual enrolled Medicaid/CHIP and subsidized exchange plans. With the enhanced subsidies ending this year the headwind is tremendous. Relevant to Medicaid carriers, CMS will audit eligibility files with the states and remove those enrolled in multiple states, a headwind for the membership count by states as well as premium. Relevant to HIX carriers, my opinion is there are two problems:

If during the Medicaid eligibility audit the member is determined to be Medicaid eligible, Medicaid will be primary. Thereby removing that member from the ACA risk pool and the HIX premium for that member due to the respective insurer terms. (I emphasize “HIX Premium” as it’s possible there are individuals on Medicaid/Marketplace plan by the same carrier.)

If during the Medicaid eligibility audit the member is determined to be ineligible for Medicaid, the HIX plan will be their form of coverage. The caveat here is that the subsidies they are currently receiving will likely be ending given the sunsetting of the eAPTC at the end of 2025.

So what does this mean in reality? The ACA membership is going to reduce either by disenrolling Medicaid eligible individuals who are on an exchange plan or by Medicaid ineligible individuals not wanting to pay the increased non-subsidized premium. A serious headwind that, as I said previously, has an impact to the entirety of the ACA risk pool. With respect to Oscar Health, my base case is that they will have to withdraw their 2027E $2.25 EPS guide, Oscar also has the most exposure to improper enrollments per Paragon’s research2

If I were a betting man, the Medicaid and HIX markets aren’t going to simply recover from rate increases. These are profound changes to the various risk pools and eligibility rules. There will be many that will simply forego insurance because of the subsidy reduction.

All of this is merely my speculation. I’m sitting on vacation writing this by a pool, but felt it was important. Frankly, something insidious has occurred here and I do not think it is out of the question that the Federal government begins to wonder why the payors in question didn’t do more to stop improper enrollments. After all, the carriers could easily implement a system that flags dual enrollments, whether across Medicaid/HIX or multi-state Medicaid, there is enough identifying information during enrollment for them to know this. It does beg the question about whether the DOJ begins inquiries at more payors.

At the very least I would imagine many of the individual insurance exchange brokers/agents will be in for a rude awakening. Revenues from HIX commissions will be meaningfully reduced. Many of these firms purposefully dual enrolled individuals when they could in subsidized plans. To those agents: it’s a paycheck, to those members: it’s low/no cost, to the carrier: it’s premium, but to you, the taxpayer, it iss subsidizing all of those parties to the tune of billions of dollars. CMS is estimating the multi-state Medicaid or Medicaid/HIX improper enrollments cost us taxpayers $14 billion annually3. It probably gets more bleak from there, however. Paragon Institute is estimating that approximately 30% of the exchange, 6.4 million people, is improperly enrolled4. There’s a variety of reasons for this and in my article I linked earlier, goes over a few of the ways CMS is looking to end this issue.

My belief is that no matter what way you cut this, the ACA marketplace carriers are in for an exceptionally tough time. Note: I do not have direct access to the Barclay’s note on this topic, but much of their work was derived from Paragon’s.

See Disclaimer.

https://www.kff.org/affordable-care-act/issue-brief/individual-market-insurers-requesting-largest-premium-increases-in-more-than-5-years/

https://paragoninstitute.org/newsletter/new-paragon-report-obamacare-enrollment-fraud-surged-in-2025/

https://www.cms.gov/newsroom/press-releases/cms-finds-28-million-americans-potentially-enrolled-two-or-more-medicaid/aca-exchange-plans

https://paragoninstitute.org/newsletter/new-paragon-report-obamacare-enrollment-fraud-surged-in-2025/