Key Trends and Challenges in Managed Care: MCOs, Medicaid, ACA, and Market Dynamics

Major Events & Themes - Past, Present, and Future

I started this Substack in March of 2024, and I want to thank all of you for the support. I have met some amazing people so far and I hope that continues. Writing this Substack has been an amazing exercise for me and I’m excited that I can share what I find interesting, I’m still finding my footing, but it’s come along nicely – most importantly, I’m happy to provide as much insight/value as I can to my subscriber. Thank you for that opportunity.

Given my experience with Managed Care Organizations (MCOs) and insurance broadly speaking, that’s what I will be focusing on with this post. Going forward I will likely make these longer and touch on any topic that interests me.

This year has been eventful for the healthcare industry, there has been non-stop news ranging from GLP-1s, Medicaid redeterminations, and cost pressures. There was even an election, one that renews concerns regarding the future of the Affordable Care Act – the largest comprehensive healthcare legislation since 1965. So let’s dive in.

Major Events & Themes: Present and Future

Increased Medical Loss Ratios

One aspect of the COVID-19 pandemic that is increasing Medical Loss Ratios is the “delay of care” that people underwent. During COVID-19, people delayed their doctor’s visits and check-ups due to mandated restrictions on elective procedures. To the layman, this may sound like you’re delaying something such as cosmetic plastic surgery, but in practice, many necessary screenings and injury visits were postponed due to this. What we are seeing in medical loss ratios now is the culmination of those delays, not only are people going to the doctor again, but in many cases they have diseases that have progressed more than they otherwise would have.

Medicaid Redeterminations

During COVID-19 the Families First Coronavirus Response Act (FFCRA) had one key component to it: Keep people continuously covered during the Public Health Emergency. What this caused was a major uptick in Medicaid enrollment. KFF estimated that the enrollment in Medicaid/CHIP increased by 23.3 million people, nearing 100 million total enrolled from February 2020 to March of 2023. CMS gave State Agencies 12 months to review and redetermine all Medicaid renewals following the ending of continuous coverage provision.

Because of the unwinding of this continuous enrollment provision, people who were enrolled in Medicaid, but shouldn’t be anymore, were finally rolled off and told to find coverage via a different avenue and as of September 2024, per KFF 25 million people were disenrolled in Medicaid.

The ACA, however, has seen a sharp uptick in enrollments this year due to these Medicaid redeterminations.

Figure 1: ACA enrollments for the years 2022, 2023, and 2024 including State Based Marketplaces and healthcare.gov by week during open enrollment starting in early November and ending in January. Source: CMS data, refined by Karst Research.

To get a better sense of the comparison directly to Medicaid, KFF produces a phenomenal tool that highlights the enrollment trends of Medicaid. For sake of seeing the impact of the FFCRA I started the chart at 2018.

Figure 2: Medicaid enrollments from Jan 2018 to July 2024. Source: Kaiser Family Foundation – KFF via CMS, Medicaid & CHIP Monthly Applications, Eligibility Determinations, and Enrollment Reports: January 2014 - July 2024 (preliminary), as of October 31, 2024. Monthly CMS Medicaid & CHIP Enrollment Reports for all periods are available from CMS here.

Enhanced Subsidies Set to End

At the end of 2025 the enhanced subsidies for ACA plans are set to expire. Unless congress decides to extend these premium tax credits, the expiration will definitely lead to loss of coverage for many of those on ACA plans. KFF estimates that ACA enrollee payments could increase by 75% on average and enrollments could drop to 15.4 million by 2030. Using the KFF tool, let’s run through an example:

“For example, two 40 year-old parents with two 10 year-old children in Davis, West Virginia making $125,000 would go from paying $885 to $2,918 per month, an increase of $2,033 ($24,392 per year). A 30 year old in Dallas, Texas making just over poverty would go from paying $0 to $24 per month (and increase of $291 per year).” - Kaiser Family Foundation

Large Cap MCO’s

United Health Group - UNH 0.00%↑

Cigna - CI 0.00%↑

Humana - HUM 0.00%↑

Elevance (formerly Anthem) - ELV 0.00%↑

Molina Healthcare - MOH 0.00%↑

Aetna - CVS 0.00%↑

Centene - CNC 0.00%↑

The MCOs – where to even begin? This year was bad. The United Healthcare CEO was assassinated. Cigna resumed Humana merger talks, only to back out yet again. Performance was lackluster in each name, none beating the SP500 and some terrible results on names with higher Medicare/Medicaid exposure. To get a sense of the performance, below is the portfolio weighting and the chart comparing the US MCOs to SPY.

What’s revealing is the pressure associated with the non-commercial blocks of business. United Health Group demands a premium, it’s the 800 lb gorilla in the room, the premium is real. However, Cigna’s focus is really commercial only. After talks with Humana fell through in late 2023/early 2024 they sold their Medicare block of business to Health Care Services Corporation (HCSC) for $3.7 billion. When the news broke that Cigna was considering acquiring Humana, they were punished harshly. I will finish by focusing on two names, Humana and Centene.

Humana - HUM 0.00%↑

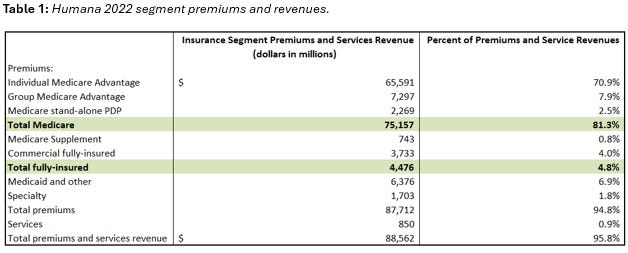

Humana is essentially the opposite of Cigna from a block of business makeup, in early 2023 they decided to exit their commercial blocks of business to focus on Medicare, Medicaid, Military, and Specialty lines. They also have a healthcare services subsidiary called CenterWell. When Humana decided to exit the commercial market, they did so on a 2 year roll off schedule, all commercial major medical lines of coverage would term by January 1st, 2025. The announcement came shortly after their 2022 10-K was released. Below is the segment information for 2022:

81.3% of their revenues were derived from core Medicare business, with 6.9% being Medicaid. Their fully insured block of business made up only 4.8% of their premiums/revenues for 2022. They did not break down their ASO revenues and the percentage make up, but given that fully insured business is typically higher in terms of premium I would venture to guess it was largely immaterial.

By the time the 2023 10-K came out you could already see a marked reduction in their commercial membership, from 2022 to 2023 their commercial fully insured membership was reduced by 39.1% and their commercial ASO membership was reduced by 40.6%. Management was attempting to cut the weeds and water the flowers, they were making a bet on Medicare, adjacent government programs, and their CenterWell business. But something else occurred in 2022 to 2023 something else happened. Their benefit ratio (MLR) increased by 140 basis points from 86.6% to 88.0%. November of 2023 marked the start of the share price tumbling.

This increase in their benefit ratio highlights a problem that’s remained: abnormally high costs associated with their Medicare block of business. Which leads us to where we are today, 2024. Earnings have reduced starkly, the nine months ended Sept 30, 2024 Humana had $15.76 in basic EPS, compare that to $24.37 in the nine months ended Sept 30, 2023. Their benefits opex increased approximately $10 million dollars, leading to a $1.2 million reduction in income for the nine months ended Sept 30, 2024.

While the financials and matter, of course, there is a nuance to the world of Medicare Advantage in the CMS Star Ratings. Humana’s star rating reduced from 4.37 to 3.63, this was a horrible outcome for Humana. They’ve sued HHS over this – it could lead to $1 billion - $3 billion. In the latest earnings call, the team at Humana stressed that they were pursuing an appeal on their stars program via the HHS litigation.

Centene - CNC 0.00%↑

I always feel that Centene is a lesser-known entity compared to the other managed care organizations. Centene has four operating segments:

1. Medicaid

2. Medicare

3. Commercial

4. Other

The Medicaid business is the largest segment, followed by commercial, Medicare, and “other.” The commercial segment is their health insurance marketplace product, known as Ambetter Health is available in 29 states. Their “Other” segment includes health plans such as Magellan Health.

While the stock price of Centene has been lackluster (INSERT PERFORMANCE TO DATE) YTD, they’re an interesting story due to the segments they capture in the overall health insurance landscape. Medicaid redeterminations and increased ACA enrollments have been at the forefront of their business specifically, you can see in their own quarterly report the impact of Medicaid redeterminations into the ACA Marketplace.

Centene has seen a 14% decrease in Medicaid enrollments year over year, but an increase in HIX (health insurance exchange) enrollments.

Similarly to what Humana has seen, Centene has reported an increase medical cost ratios driven by high acuity Medicaid membership. Centene experienced an MLR of 89.2% for the 3rd quarter of 2024, a 2.2% increase year over year. Focusing on Centene’s Medicare block of business, their star quality also took a hit – management has mentioned a driver of this being disaster relief provisions being rolled off as well as classic metrics deteriorating. They’re currently anticipating operating the 2025 Medicare Plan year at a loss and recording a premium deficiency reserve in Q4 2024.

My Exposure and a thought on ICHRA

As many of you probably know, I’ve been long Oscar Health OSCR 0.00%↑ since late 2022. With my initial purchases <$3. I’ve averaged up along the way and I am still long. The stock has performed well, albeit with some volatility. The enhanced subsidies being removed are an inherent pressure to all marketplace based plans, but I believe the company will continue to outperform going forward. They have an exceptional management team.

Oscar is building out an ICHRA platform, it’s become a very hot topic for employer based group plans. If you’re unaware of ICHRA - it’s an Individual Coverage Health Reimbursement Arrangement. Rather than a offering a typical group health insurance plan, ICHRA allows employer’s to provide a pre-tax dollar amount to their employees to purchase an individual plan. It will be interesting, as a general point, to see what Oscar’s ICHRA adoption looks like. All signs point to ICHRA gaining traction and Oscar, in my opinion, will be a good bellwether for how this arrangement is viewed in the marketplace.

As always, find me on X/Twitter — my DM’s are open. None of this should be considered investment advice, it is for informational purposes.